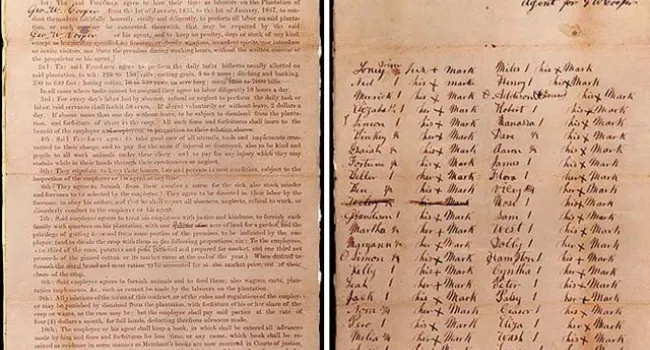

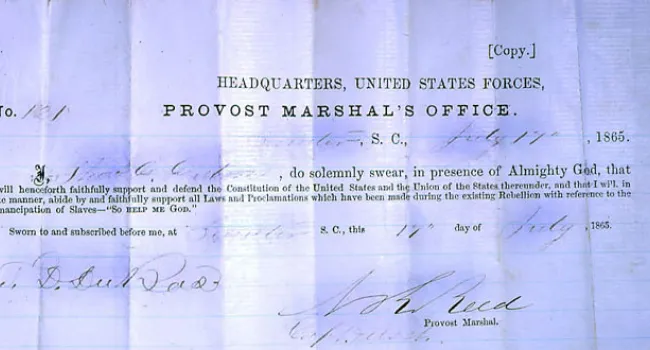

Forfeited estate plat from Port Royal Island. The surveyor reported, "This tract subject to Mrs. Poingsett's Right of Dower during her life." The plat--an official map made by a surveyor that gave the legal definition of a piece of land--is an interesting one for several reasons. It shows clearly the location of the "mansion" and the "Negro quarters" on a plantation. The note about the "dower rights" reminds us that women in South Carolina lived under special limits but had some special protections as well. A widow was entitled to one-third of her husband's estate as her "dower right," and the enforcement of the federal direct tax did not destroy that right. The direct tax was a national tax of $29 million, passed by Congress in August 1861 to finance the war, and levied on all states, including those that had seceded. South Carolina's share was $363,570. A new law in 1862 provided that, where the rebellion made it impossible for federal tax collectors to collect the tax, a penalty should be added, and the land sold to pay the debt. In the area around Beaufort, where federal troops controlled the countryside from November 1861 onwards, 47 tracts of land were confiscated for failure to pay the direct tax.

Courtesy of the South Carolina Department of Archives and History.

Standards

- This indicator was developed to encourage inquiry into the continuities and changes experienced by Americans of various genders, positions, races, and social status during the Civil War.

- 8.3.E Utilize a variety of primary and secondary sources to analyze multiple perspectives on the effects of the Civil War within South Carolina and the United States.